In recent years, automated trading strategies in Forex have attracted significant attention due to their capacity to remove human emotions and biases, paving the way for more efficient and systematic trading.

These strategies execute trades automatically, following predetermined rules and conditions, which reduces the need for constant monitoring.

In this in-depth guide, we will give an initial overview and then look at the seven steps required to create a profitable and reliable automated trading strategy using a Forex robot.

Key Takeaways From Our Guide

- Understand the role of Forex robots: Forex robots, or expert advisors (EAs), automate the trading process by analyzing market data, identifying trading opportunities, and executing trades based on predefined rules and criteria. They help save time, reduce emotional decision-making, and maintain a disciplined trading approach.

- Develop a profitable trading strategy: Establish clear trading goals, choose an appropriate trading style and time frame, select suitable currency pairs, analyze fundamental and technical factors, and implement effective risk management guidelines to create a solid foundation for your automated Forex trading strategy.

- Choose the right Forex robot: Evaluate the performance, reliability, compatibility, features, and settings of various Forex robots, and verify the vendor’s reputation and customer support to ensure the success of your automated trading strategy.

- Fine-tune and optimize your Forex robot: Optimize the settings of your chosen Forex robot, incorporate additional indicators or filters, and strike a balance between risk and reward through optimization. Regularly review and update the robot’s performance to maintain its effectiveness.

- Monitor and evaluate your automated trading strategy: Track performance metrics, conduct regular backtesting and forward testing, adapt your strategy to changing market conditions, and balance manual intervention with automation to ensure the long-term profitability and reliability of your trading strategy.

The Role of Forex Robots In Automated Trading

Forex robots, also known as Expert Advisors, EAs or Bots play a vital role in automated trading by automating the trading process within the Forex market. They are programmed to analyze market data, pinpoint trading opportunities, and execute trades on the trader’s behalf, adhering to a predefined set of rules and criteria. They aid traders in saving time, reducing emotional decision-making, and maintaining a disciplined trading approach, ultimately enhancing the potential for profit.

The key features and components of Forex robots

Typically, Forex robots comprise a set of algorithms that analyze various market data, such as price movements, volume, and indicators. They often include risk management features, like stop-loss and take-profit orders, which protect the trader’s capital. Some advanced Forex robots even utilize machine learning and artificial intelligence techniques to adapt to evolving market conditions.

Advantages and disadvantages of using Forex robots

When considering the use of Forex robots, it’s crucial for traders to weigh both the advantages and disadvantages to make an informed decision.

On one hand, top performing Forex robots can streamline the trading process and improve overall performance by reducing the impact of human errors and emotional decision-making.

On the other hand, the potential for over-reliance on these automated systems may lead to complacency or a lack of understanding of the underlying market dynamics.

To maximize the benefits of Forex robots while mitigating their drawbacks, traders should maintain a balanced approach, combining automated trading with manual analysis and intervention when necessary. Regularly updating and monitoring the performance of the Forex robot, as well as incorporating a strong risk management strategy, can further optimize the trading experience and enhance the potential for long-term success.

7 Steps To Creating A Profitable And Reliable Automated Trading Strategy Using A Forex Robot

We will now look at the 7 steps required to create a profitable and reliable automated trading strategy with an FX robot in the following sequence:

- Developing a profitable trading strategy

- Choosing the right Forex robot

- Fine-tuning and optimizing your Forex robot

- Monitoring and evaluating your automated trading strategy

- Conducting regular backtesting and forward testing

- Adapting your automated Forex trading strategy to changing market conditions

- Balancing manual intervention with automation

STEP 1: Developing a Profitable Trading Strategy

Creating a profitable trading strategy is a crucial aspect of successful automated trading. To begin, traders must establish clear and realistic trading goals that take into account their risk tolerance, available investment capital, and desired returns. Defining these objectives helps guide the selection of an appropriate trading style, time frame, and risk management approach.

Furthermore, traders should also consider the frequency of trading opportunities and the potential impact of market events on their strategy.

Identifying a suitable trading style and time frame

Next, traders must identify a suitable trading style that aligns with their goals, personality, and available time. This could include day trading, swing trading, or position trading, each requiring different time frames and commitment levels.

When choosing currency pairs to trade, it’s essential to consider factors like liquidity, volatility, and correlation with other pairs. Additionally, it’s crucial to factor in the time zone differences and trading sessions that may affect the availability of trading opportunities and market conditions.

Selecting appropriate currency pairs

Focusing on a select few currency pairs allows traders to gain a deeper understanding of their specific market dynamics.

A comprehensive trading strategy should encompass both fundamental and technical analysis. Diversifying across multiple currency pairs can also help reduce risk and increase the likelihood of capturing profitable trades, as long as the trader maintains a manageable portfolio and avoids overexposure to highly correlated pairs.

Analyzing fundamental and technical factors

While fundamental analysis examines macroeconomic indicators such as interest rates and economic growth to determine a currency’s intrinsic value, technical analysis focuses on historical price movements and patterns to forecast future price trends.

To enhance the effectiveness of their trading strategy, traders should combine both types of analysis, using fundamental factors to identify long-term trends and technical tools to pinpoint optimal entry and exit points.

Establishing risk management guidelines

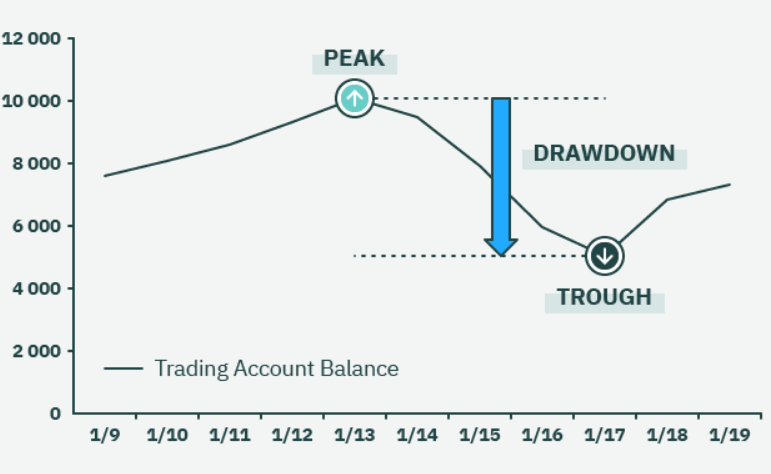

Additionally, effective risk management is crucial for a profitable trading strategy, requiring guidelines such as position sizing, stop-loss orders, and maximum drawdown limits to protect the trader’s investment capital and minimize the likelihood of significant losses.

Setting realistic profit targets is another essential aspect of risk management, as it helps traders maintain a healthy risk-reward ratio and avoid the temptation to chase unrealistic gains that may expose them to excessive risk.

The Importance Of A Well-Designed Strategy for Profitability and Reliability

A well-structured trading strategy is paramount to achieving consistent profitability and minimizing risks in automated trading. Such a strategy should be grounded in a solid understanding of market dynamics, sound risk management principles, and rigorous testing to ensure long-term success.

- An essential component of a well-designed trading strategy is the identification of a clear trading edge. This edge represents a market inefficiency that can be exploited to generate profits consistently. Traders must develop a deep understanding of the financial instruments they trade, as well as the underlying factors driving price movements. This knowledge enables them to create a robust trading system that takes advantage of market opportunities while effectively managing risk.

- In addition to identifying a trading edge, a successful strategy should incorporate a systematic approach to trade execution and management. This includes setting specific entry and exit rules, position sizing guidelines, and risk management techniques such as stop-loss and take-profit orders. By adopting a disciplined and rules-based approach, traders can avoid emotional decision-making and impulsive actions that often lead to losses.

- A well-designed trading strategy should be adaptable to changing market conditions. This flexibility allows traders to adjust their strategies when market dynamics shift or their trading edge weakens. By continuously monitoring the performance of their strategy and making necessary adjustments, traders can maintain the effectiveness and profitability of their automated trading systems.

STEP 2: Choosing the Right Forex Robot

Selecting the most suitable Forex robot is a critical step in ensuring the success of your automated trading strategy. Before deciding on a Forex robot, it’s important to evaluate its performance and reliability based on historical data, backtesting results, and real-world trading performance.

Comparing these metrics across various Forex robots can help you determine which ones are most compatible with your trading strategy and risk tolerance.

Moreover, considering the Forex robot’s developer reputation and user reviews can provide valuable insights into its overall quality and effectiveness.

Assessing the compatibility of the robot with your trading strategy

It’s also essential to assess the compatibility of the robot with your trading strategy, ensuring that it aligns with your preferred trading style, time frame, and currency pairs. Additionally, the robot should support your risk management guidelines and demonstrate a proven track record of profitability and reliability.

To achieve the best results, verify the Forex robot’s adaptability to changing market conditions and its ability to adjust its strategy based on your trading goals and evolving market dynamics.

Analyzing the robot’s features and settings

A thorough analysis of the Forex robot’s features and settings is crucial for understanding its potential effectiveness. Evaluating the robot’s built-in indicators, algorithms, and risk management tools ensures they align with your trading strategy. Customizable settings allow you to fine-tune the robot to better accommodate your specific needs and preferences.

- User Interface and Ease of Use

In addition to the core features, it’s essential to consider the user interface and ease of use of the Forex robot. A user-friendly interface, well-organized documentation, and straightforward setup process can significantly improve your trading experience, making it easier to manage and monitor your automated trading strategy.

Ensuring that the Forex robot is compatible with popular trading platforms, such as MetaTrader 4 or 5, can also provide a seamless and efficient trading experience.

- Customer Support and Community

It’s equally important to assess the quality of customer support provided by the Forex robot’s developer.

Responsive and knowledgeable customer support can help you quickly address any potential issues or challenges you may encounter while using the robot. Moreover, a strong community surrounding the Forex robot can provide valuable insights, shared experiences, and advice from other users, further enhancing your understanding and confidence in the robot’s capabilities.

Verifying vendor reputation and customer support

Research the vendor’s reputation to ensure they are reliable and trustworthy before purchasing a Forex robot.

- Do they have their performance figures verified on the reputable verification site MyFXBook or FX Blue?

- Read reviews and testimonials from other users will provide insights into the robot’s performance and the quality of customer support offered by the vendor. A reputable vendor should be able to promptly and effectively address any issues or concerns that may arise.

STEP 3: Fine-tuning and Optimizing Your Forex Robot

Once you have chosen a Forex robot, it’s essential to optimize its settings to achieve the best possible performance. This process may involve adjusting various parameters such as trade size, stop-loss and take-profit levels, and the sensitivity of built-in indicators. It’s crucial to thoroughly test these adjustments using historical data and forward testing to confirm they improve the robot’s performance.

Evaluating Performance Metrics

As you fine-tune and optimize your Forex robot, it’s essential to track performance metrics that reflect the effectiveness of the adjustments you’ve made. Metrics such as win rate, risk-reward ratio, average trade duration, and drawdown can help you gauge the robot’s performance and identify areas for further optimization.

By monitoring these metrics, you can ensure that the changes you make to your Forex robot’s settings contribute to improved overall performance.

Incorporating additional indicators or filters

To further enhance your Forex robot’s effectiveness, consider incorporating additional indicators or filters. These refinements can help improve entry and exit signals and reduce the occurrence of false signals. However, it’s important to avoid over-complicating your trading strategy, as excessive complexity can lead to over-optimization and diminished effectiveness. Striking a balance between risk and reward is critical for long-term success in automated trading.

Regularly updating and adapting your Forex robot

The market conditions are constantly changing, and it is crucial to keep your Forex robot up-to-date and adaptable to these fluctuations. Regularly reviewing and updating your Forex robot’s performance ensures that it remains effective and aligned with your trading strategy.

By staying informed about market trends and incorporating new developments into your trading strategy, you can maintain a dynamic and profitable automated trading system.

By incorporating additional indicators or filters, and regularly updating its settings, you can optimize your automated trading strategy and achieve greater success in the Forex market.

Step 4: Monitoring and Evaluating Your Automated Trading Strategy

Continuous monitoring and evaluation of your automated trading strategy are essential to ensure its ongoing effectiveness and profitability.

Tracking performance metrics

Start by keeping track of performance metrics such as win rate, risk-reward ratio, and drawdowns to assess the strategy’s success over time.

Analyzing trade performance

Beyond tracking quantitative metrics, it’s also important to analyze the individual trades executed by your automated strategy. This can help you identify any recurring patterns, such as consistent profits or losses during specific market conditions. By understanding these patterns, you can make targeted adjustments to your strategy to improve its overall performance.

Adjusting your strategy based on performance insights

As you monitor and evaluate your automated trading strategy, you may identify areas that require optimization or adjustment. By making data-driven changes to your strategy, you can ensure that it remains relevant and profitable in the ever-changing market landscape.

Regularly reviewing and refining your strategy is crucial for maintaining its effectiveness over time.

Keeping up with market developments

In addition to monitoring your automated trading strategy’s performance, it’s essential to stay informed about market developments and trends that may impact your strategy.

By staying abreast of economic news, market analysis, and emerging trading techniques, you can ensure that your strategy remains adaptable and capable of capitalizing on new opportunities in the Forex market.

By diligently monitoring and evaluating your automated trading strategy, you can make informed decisions about adjustments and refinements, ensuring that it remains effective and profitable in the long term.

Step 5: Conducting Regular Backtesting and Forward Testing

Regular backtesting and forward testing are essential practices in the ongoing evaluation of an automated trading strategy. These testing methods provide insights into the strategy’s performance and help identify any potential weaknesses that may require adjustments. By consistently conducting these tests, traders can ensure the long-term success of their automated trading strategy.

Backtesting involves using historical market data to test the effectiveness of a trading strategy. This process allows traders to simulate how their strategy would have performed in the past, providing valuable insights into the strategy’s potential profitability and risk exposure.

When backtesting, it is crucial to consider various market conditions, including different time frames, volatility levels, and economic events, to ensure a comprehensive evaluation.

Some essential factors to consider while backtesting include:

- Data quality: Ensure that the historical data used for backtesting is accurate and free from errors, as faulty data can lead to misleading results.

- Appropriate time frame: Choose a time frame that aligns with the trader’s preferred trading style and strategy, as different time frames can yield varying results.

- Performance metrics: Assess the strategy’s performance using relevant metrics, such as win rate, risk-reward ratio, and maximum drawdown.

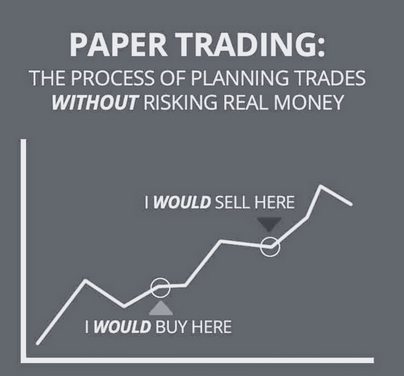

Forward testing, also known as paper trading or walk-forward testing, involves testing a trading strategy in real-time using a simulated trading environment. This method allows traders to observe how their strategy performs under current market conditions without risking real capital.

Forward testing can reveal any potential issues that may not have been apparent during backtesting, such as the impact of slippage, latency, and other real-world factors.

Some key considerations for forward testing include:

- Consistent execution: Ensure that the simulated trading environment accurately reflects the conditions of live trading, including order execution, spreads, and fees.

- Realistic expectations: Maintain realistic expectations about the strategy’s performance and avoid over-optimization based on short-term results.

- Ongoing evaluation: Continuously monitor the strategy’s performance during forward testing and make adjustments as needed to adapt to changing market conditions.

Conducting regular backtesting and forward testing is vital for maintaining a profitable and reliable automated trading strategy. These testing methods help identify potential weaknesses and inform necessary adjustments, ensuring that the strategy remains effective in various market conditions.

By using clear and concise language, traders can better understand the importance of these testing methods and apply them to their automated trading strategies for long-term success.

Regular backtesting and forward testing are crucial to identify any potential weaknesses in the strategy and make necessary adjustments.

Step 6: Adapting your automated Forex trading strategy to changing market conditions

As market conditions evolve, it’s vital to adapt your strategy accordingly to maintain its effectiveness and alignment with your trading goals. Striking a balance between manual intervention and automation is also an important aspect of managing your automated trading strategy.

Through staying engaged in the process and making informed decisions based on the performance data, you can ensure that your trading strategy remains both profitable and reliable in the long run.

Recognizing market shifts and trends

Successful adaptation of your automated trading strategy requires an understanding of market shifts and emerging trends. With regularly reviews of market news, analysis, and economic data, you can identify potential changes in market conditions and make proactive adjustments to your strategy, preventing losses and maximizing gains.

Fine-tuning your strategy based on market insights

In response to changing market conditions, you may need to fine-tune specific aspects of your automated trading strategy. This could involve adjusting your risk management rules, incorporating new technical indicators, or modifying your trading algorithms. Periodic fine-tuning ensures that your strategy remains well-suited to the current market environment and continues to generate profits.

Balancing flexibility and consistency

While adapting your strategy to changing market conditions is essential, it’s also important to maintain a certain level of consistency in your trading approach. Striking the right balance between flexibility and consistency will help you avoid overreacting to short-term market fluctuations while still allowing your strategy to evolve and improve over time.

By actively monitoring market conditions and adjusting your automated Forex trading strategy as needed, you can maintain its effectiveness and profitability, ensuring long-term success in the dynamic Forex market.

Step 7: Balancing manual intervention with automation

This ongoing evaluation process helps traders stay in control of their trading strategies while making the most of the advantages that automated trading offers.

Knowing when to intervene

An essential skill in balancing manual intervention with automation is knowing when to step in and make adjustments to your automated trading strategy. It is crucial to monitor the performance of your Forex robot closely and recognize when market conditions may require manual intervention.

Factors such as significant economic news events, sudden shifts in market sentiment, or technical issues with the trading platform may necessitate a trader’s involvement to safeguard their investments and ensure the strategy remains effective.

Striking a balance between manual intervention and automation is key to managing a successful Forex trading strategy.

By staying engaged in the process, monitoring performance, and making adjustments as necessary, traders can maintain control over their strategies and maximize their potential for long-term profitability and reliability.

Conclusion

Creating a profitable and reliable automated trading strategy using a Forex robot requires careful planning, execution, and ongoing monitoring. By understanding the intricacies of Forex robots and developing a well-crafted trading strategy, traders can harness the power of automation to achieve consistent results.

Selecting the right Forex robot, fine-tuning its settings, and regularly evaluating its performance are crucial steps in maintaining the effectiveness of the automated trading strategy.

Through striking a balance between automation and manual intervention, traders can stay in control of their trading strategies while maximizing the potential for profit and minimizing risks in the dynamic Forex market.

Written by Chris Gillie

Chris Gillie is the founder of Axcess FX, a Forex software review and research website. He is a former investment banker who worked in FX Sales on the UBS London trading floor. Chris has been using Forex trading software as part of his trading set-up since the late 2000s and the embryonic days of MetaTrader and the MQL coding language.