The benefits of Forex trading tutorials range from getting beginners quickly up and running with trading basics, to advanced training for seasoned traders, looking to improve in a specific type of technical analysis.

Tutorials are sufficiently insightful as the people behind them usually come from a trading background and with the varying methods of delivery, tutorials can make the learning process exciting and motivational.

In this article, we will look at the main benefits of Forex trading tutorials, but also, the different ways you can take a tutorial and where to find the best Forex trading tutorials online.

Read on and start your trading journey on the correct path to success.

How Are Forex Tutorials Delivered And Who Would Each Method Suit?

Forex trading tutorials can be delivered in differing formats, catering for varying learning styles and preferences. Each delivery method offers unique benefits and suits the different needs of traders, from newcomers to experienced traders, looking to refine their technique and strategy.

In our easy to read table below we list each tutorial method to give an instant overview of what might work best for you.

| Tutorial Method | Description | Who Would It Suit |

|---|---|---|

| Online courses | Online platforms provide structured courses for all levels of Forex trader. The courses can include a blend of written material, video lectures, quizzes and interactive components | Great for self-paced learning |

| Webinars and live workshops | Live webinars and workshops are conducted by educational platforms and trading experts. They offer real-time interaction with instructors, allowing for immediate Q & As | Those looking for specific topics or strategies |

| Video tutorials | Platforms like YouTube offer video tutorials, ranging from comprehensive guides to shorts, focusing on specific aspects of Forex trading | Particularly helpful for visual learners |

| E-books and digital guides | E-books and digital guides offer easily accessible information in written form, serve as handy reference materials and range from basic guides to advanced trading concepts | For those who prefer reading to other learning formats |

| Interactive trading apps and games | Apps and games are designed to teach Forex trading in an interactive and engaging way by gamifying the learning process to make it accessible and fun | For learners who find standard methods overwhelming |

| Demo trading accounts | Most online brokers provide free demo accounts where Forex traders can practice with virtual money. These platforms are providing the chance to apply knowledge in a risk-free environment | For newbies wanting hands-on experience and knowledge |

| Mentorship programs | Some traders chose personalized mentorship programs where a seasoned trader gives one-on-one guidance, bespoke advice and direct feedback | For those seeking in-depth, customized learning |

| Trading forums and online communities | The participation in online communities and forums is a form of tutorial as members share advice, strategies and experience that gives valuable insights and peer support | For those that like to learn through community participation |

| Seminars and conferences | Attending conferences and seminars affords opportunities to hear from multiple experts, network with other traders | Forex traders wanting to stay updated on the latest trends and strategies |

| Workbooks and exercise sheets | Exercise sheets and workbooks provide a hands-on approach to learning, including Forex trading scenarios, strategy planning exercises and calculations | For those who learn best through practice |

What Are The Benefits Of Forex Trading Tutorials

Here at Axcess FX, we strongly believe in the merits of Forex trading tutorials and have identified several key benefits that traders of all levels can enjoy from participating in tutorials.

Constructing a trading mindset

Having the right mindset is just as important as knowledge and strategy to become a successful trader. Forex tutorials typically emphasize the significance of patience, discipline, emotional control and ongoing learning. Tutorials instruct traders to deal with wins and losses objectively and to adhere to a focused approach to trading.

Access to expert knowledge

Many tutorials are produced by industry professionals and expert traders, providing access to real-world experiences and expert insights. Such varied perspectives and advanced trading techniques are not always available in standard texts.

Staying updated

Forex trading tutorials often provide insights into current market trends and how to adjust strategies and trading systems to respond to any changes. As the Forex market is so dynamic, it help traders stay relevant and responsive.

Personalized learning

Forex trading tutorials, as we have evidenced in the table above, come in various formats, from online courses to interactive webinars and video tutorials. The variation really allows traders to select learning resources that best fit their learning preferences and pace to learn, enabling different learning styles and time schedules.

Avoiding common pitfalls

Particularly, for newcomers, it is easy to fall into common Forex trading traps. Tutorials, presented by seasoned professionals are well placed to educate about these mistakes. Learning upfront about pitfalls like overtrading and having a trading plan in place can save traders from making costly oversights.

Understanding the basics

Forex tutorials are a great resource for grasping the fundamentals of Forex trading. Key topics like how the global currency market works and essential trading terms is crucial foundational knowledge for new traders to successfully navigate the Forex market.

Developing trading strategies

Tutorials will explore a variety of trading strategies from both a short-term and a long-term approach. It will include strategies such as day trading, swing trading and position trading. It allows traders to try out different strategies and find one that ties to their goals, risk tolerance and investment time-line.

Risk management

A vital area covered in trading tutorials is managing risk and includes:

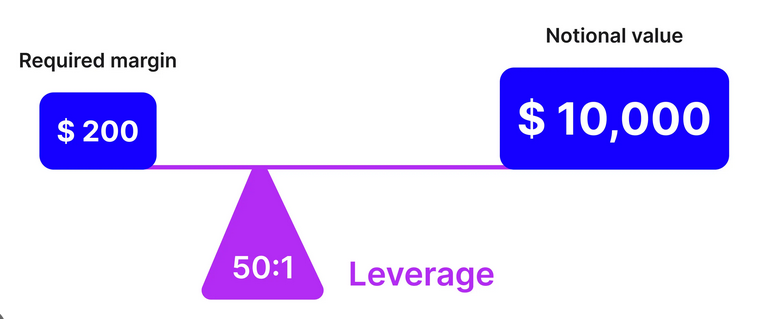

- Learning about leverage, its risks and how to use it wisely

- Understanding how to use stop-loss orders to limit any sudden loss to capital on your trading account

- How to trade with just a small percentage of your capital

Finding The Best Online Trading Tutorials

We have outlined the significant number of tutorial methods that exist, ranging from online courses, to webinars and E-books. With such a wide ranging choice, how do you find suitable trading tutorials for your needs?

Don’t worry, if you struggle to find suitable tutorials, we have also done some heavy lifting for you and have drawn up a short list of options for different tutorial methods.

Online course options

Babypips.com offer an excellent free online course for new Forex traders at their School of Pipsology

Udemy is a great resource for high quality well-priced Forex courses

Webinars

Forex.com offer a range of Forex webinars for both beginners and experienced traders and you can find the webinars at this link at their trading academy.

Video tutorials

YouTube is an excellent source for Forex video tutorials and an excellent one for beginners, is the Ultimate Forex Trading Course by Raynor, who has almost 2 million subscribers. The course is 2 hours long and the video is below for your convenience.

Demo trading accounts

Reputable online Forex brokers offer free demo accounts for beginners to trade with virtual money in a simulated environment. Interactive Brokers, Oanda and Forex.com all offer free accounts for simulated trading.

Mentorship programs

Forexsignals.com offer one of the most comprehensive mentorship programs with access to mentors, a live trading room and proprietary trading tools. We have written a review of Forexsignals.com which you can read about.

Other options include Traders Academy Club and Asia Forex Mentor.

Trading forums

Well known Forex trading forums and online communities that are worth checking out include Forex Peace Army, Reddit, Forex Factory and Babypips.

E-books

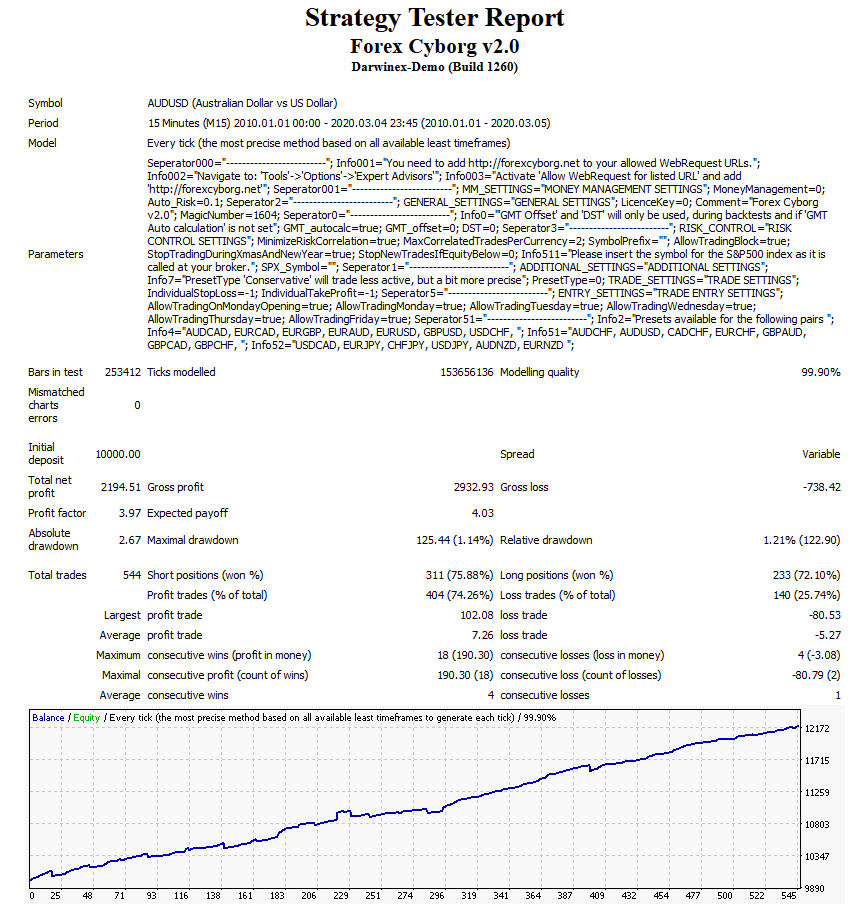

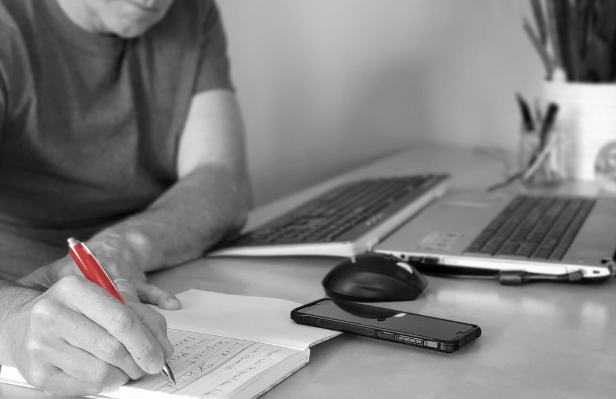

E-books are a valuable learning resource. Our Axcess FX lead contributor, Chris Gillie has written an in-depth 80-plus page E-book called “How To Trade Profitably With Forex Robots.” It has now been published on Kindle. To find out more, read our free intro by clicking on the image below.

Final Thoughts

Trading tutorials are essential, as without learning the basics of Forex, you may incur losses on your Forex broker capital account. Armed with knowledge and employing a coherent trading strategy, including risk management, all of which you can learn through tutorials, means you will be well placed to trade proficiently.

Additional Resources

Written by Chris Gillie

Chris Gillie is the founder of Axcess FX, a Forex software review and research website. He is a former investment banker who worked in FX Sales on the UBS London trading floor. Chris has been using Forex trading software as part of his trading set-up since the late 2000s and the embryonic days of MetaTrader and the MQL coding language.