Statistics place those that make money trading Forex at between 10% and 30% of all market participants. Whether trading personally or professionally Forex trading is not guaranteed to make you money.

So how do you make money in Forex? How can you increase your chances of success in one of the fastest moving financial markets?

Read on, and we will explain how.

How Can you Make Money in Forex Trading?

If you are a retail investor, Bloomberg report that research undertaken by Forex broker FXCM of its retail clients highlights that 68% of accounts had a net trading loss.

It indicates that one in three retail Forex traders did not have a loss on their account, but it does not give a glowing confirmation that everyone becomes rich from trading in Forex.

If you are well researched and disciplined, you can be one of the 32 % of traders who do not lose money trading Forex even going on to make a good income from the markets. Financial rewards can be substantial if you can differentiate yourself and become a skilled Forex trader.

How Much Can you Make Trading Forex?

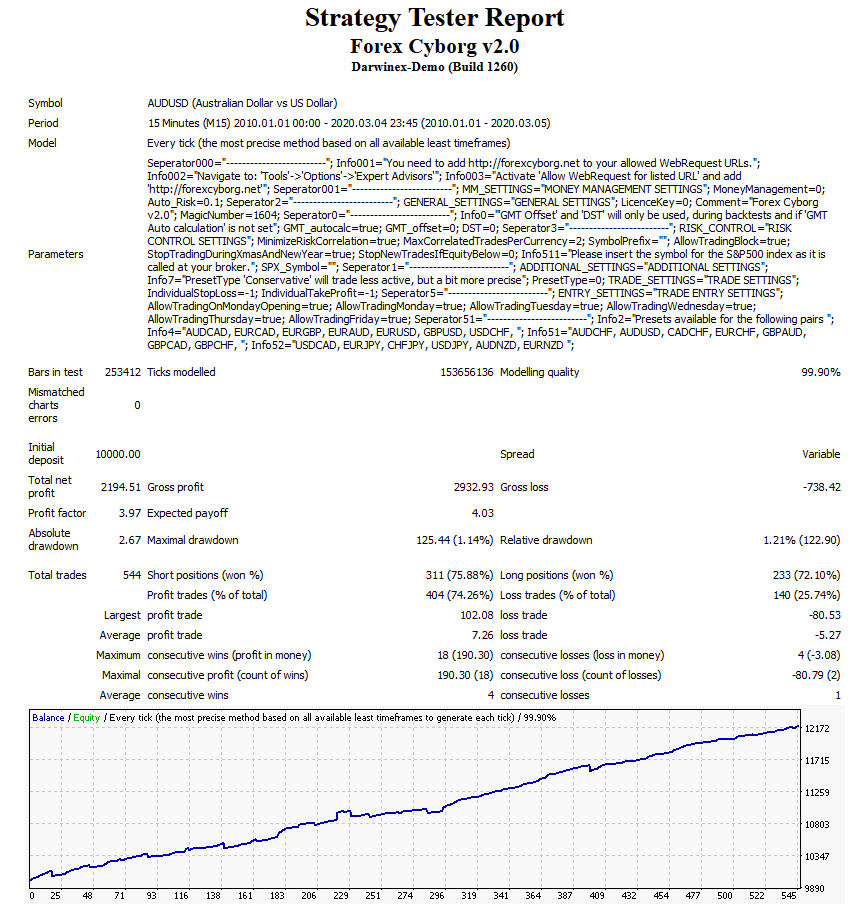

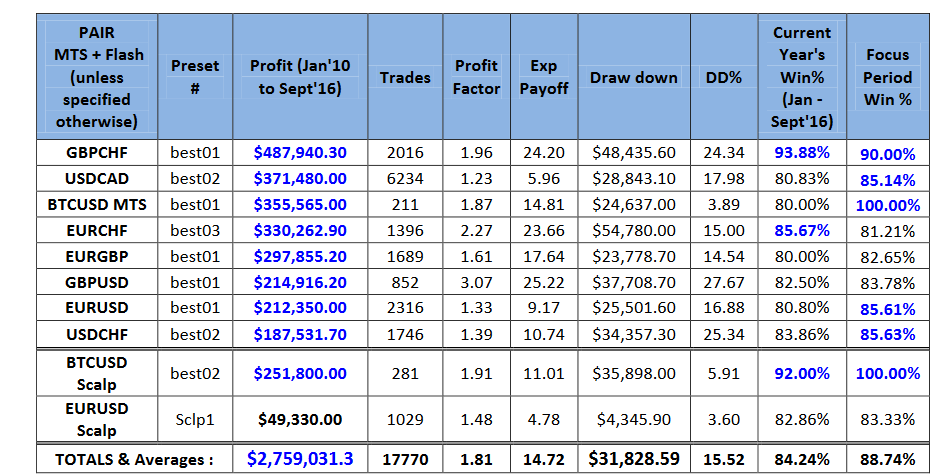

A robust Forex trading system should win 50% of the time if you have the right trading conditions to undertake a sufficient number of trades. If you are day trading EUR/USD, it may prove challenging to find up to 5 suitable transactions a day if the market is trading in a narrow range.

Assume your strategy limits a losing trade to 6 pips and attempts to make nine pips on winning deals, and you have $10,000 capital in your trading account. 10:1 leverage with a maximum risk of $100 per trade (1% of $10,000), your leveraged trading position is $100,000. The maximum risk is $60 per trade (6 pips of $100,000).

Assume you trade EUR/USD five times a day on 20 trading days a month which is 100 trades a month

A 9 pip win = $90 per trade x 50 transactions per month = $4500

A 6 pip loss = $60 per trade x 50 transactions per month = $3,000

Your net profit is 1245 US dollars per month

Six Basics To Follow To Make Money From Forex

We have listed the following essential points that you need to adhere to make money when you trade in Forex and keep your your capital account stable.

1. Trade Forex less to gain more

Try and focus on the trades that will make the most significant gains rather than trading for its own sake. To do this, you must always be informed and alert.

2. Do not diversify

Stick to trading one currency or specific currency pairs and become an expert on it. If you are having success trading GBP/USD why would you start trading EUR/JPY

3. Understand compounding growth

Small gains compounded over time can produce some astonishing results. Consider the following. If you target a 50% annual profit, you can grow a $10,000 account into over $250,000 in under ten years

4. Make your stop loss into a stop profit

Always maintain your stop loss at its original level. Only move it up when the position is well in profit, but don’t trail your stops too close. Give that open position a chance to run.

5. Give your positions breathing space

Trading can be volatile. If you are after a significant gain give your trade breathing space with a stop-loss that takes account any market volatility

6. Limit risks but maximize your chance of success

Many traders lose money not by market direction but through unstable financial markets that take out tight stop losses. Consider buying in or at the money options to avoid getting stopped out rather than trading the underlying spot.

12 Ways to Avoid Losing Money in Forex Trading

It is essential to have a rigorous system in place to minimize losing money. Below we list the most critical areas of consideration to help reduce the risk of losing money.

1. Do your research

Do not dive in and trade if you have no underlying knowledge of the Forex markets. Here are the key areas to consider

- Understand how foreign exchange works, including quotes and what factors affect it.

- Will you use technical analysis or fundamental analysis?

- Will you use manual or automated software?

- Which domestic and foreign currencies or currency pairs will you trade?

- What hours and which session (European, Asian, US) will you operate?

2. Use a reliable broker

Only open an account with a broker that is registered with both the CFTC and the NFA. A central issue here is making sure your deposit and funds in an account will be safe. Interactive Investors, Oanda, TD Ameritrade, IG USA and Forex.com are CFTC and NFA regulated brokers.

3. Make use of a demo account

Good brokers will have a demo account for you to use before going live. Make full use of this to practice getting familiarity with the broker platform, so order errors do not occur when you go live.

4. Begin with small trades and pre-plan

If you have had success with a practice account, it is a great start. When going live, a critical risk is emotion as real money is at stake. Trading in a small size will allow you to practice minimizing emotion, which is an unwanted part of trading. Emotional trading occurs when you do not pre-plan your trades.

5. Protect the downside

Always put a stop loss in place to protect your trading account. Foreign exchange is a fast-moving financial instrument. Unexpected news can move the Forex market and if you have a leveraged position without a stop loss, this could wipe out your cash.

6. Exit trades properly

If you are in a winning position, do not come out too early. If you are in a losing position, do not compound the damage. Try and minimize stress and emotion in your decisions.

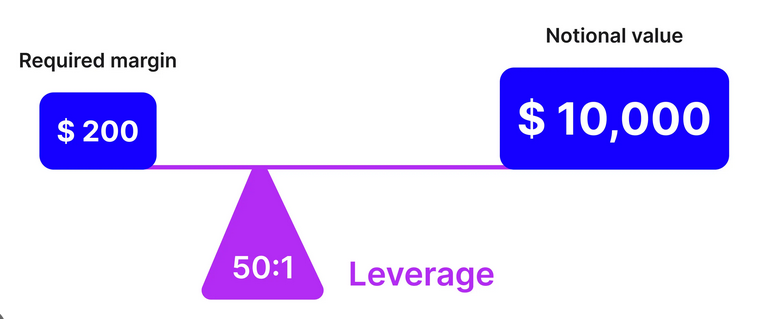

7. Be aware of leverage

Leverage should be used with care when you are starting in Forex. Brokers can offer up to 50 times of leverage. If you have $5,000 in your account, a $250,000 position results from using 50:1 of leverage.

8. Do not trade for the wrong reasons

If a currency pair is not moving, do not enter a trade just because you are bored. Have a trading strategy in place for your trade.

9. Do not give up too easily

Getting trades wrong is normal. Even if you are having a bad trading day, try and keep to your daily trading limits and not quit because you are losing.

10. Maintain accurate account book-keeping

Keep an accurate record of every trade. Having instruments traded, why you entered into a position, and the profit and loss to hand can help you identify mistakes and avoid doing them in the future.

11. The impact of tax

What is the impact of tax on your FX trading? Ensure you do not have any unexpected tax bills to pay from your FX trading. A tax specialist can also advise if your trading can be tax efficient.

12. Trading is a business

You do not become a successful FX trader overnight. Stay organized, set realistic goals, and treat every day as just another day at the office, whether you have winning or losing trades.

Key Takeaway

Can you make money trading Forex? The answer is there are no guarantees you will successfully trade Foreign Exchange. However, being organized, disciplined, and having a trading strategy in place will give you the best chance of being one of the 32% of retail traders that do not lose money in the Forex market. For further relevant articles we have written further tips on how to trade forex profitably and how to maintain focus when trading.

Written by Chris Gillie

Chris Gillie is the founder of Axcess FX, a Forex software review and research website. He is a former investment banker who worked in FX Sales on the UBS London trading floor. Chris has been using Forex trading software as part of his trading set-up since the late 2000s and the embryonic days of MetaTrader and the MQL coding language.