The difficulty with short-term Forex trading strategies includes the unpredictable effects of volatility compared to longer-term trading strategies.

Macro-events like economic data, monetary policy announcements and geopolitical events, can instantly move the market and affect short-term trading strategies such as scalping, day trading and swing trading which have tight stop-loss orders. Position trading is less affected by singular events as traders are looking at long-term trends.

We will look at seven key difficulties faced by traders that use short-term Forex trading strategies, including the effects of volatility. We also touch upon the differences between short and long term trading strategies, so that you can make an accurate assessment of what will work best for you.

Market Volatility Caused By Macro-Events

The problem with short term Forex trading lies in an unexpected macro-event or other significant news that moves the market more than your hourly chart or technical analysis on a given day. For scalpers and day traders it can have a profound effect including:

- Opportunity cost: Short-term FX traders may miss out on broader trends while they focus on the immediate market reaction

- Whipsaw patterns: Macro-events cause prices to change directions quickly triggering confusing entry and exit signals

- Liquidity fluctuations: Liquidity can dry up before macro events resulting in larger spreads and slippage, increasing trade entry/exit costs

- Stop-loss hunting: Around macroeconomic-events, prices might spike briefly taking out the tight stop-loss levels of short-term Forex traders

- Competition from algorithmic trading: Trading algorithms react to macro-events in milliseconds putting them ahead of human traders

- Forecasting difficulties: Short-term traders who bet on outcomes of a macro-event may find themselves on the wrong side of a trade

Shorter Time Frames Provide Less Reliable Signals

Technical analysis patterns and indicators appear more frequently on shorter time frames but they have less reliability than longer time frames, where support and resistance levels become more established and take on greater significance.

Furthermore, as you drill down in time frames, the charts become more polluted by false moves and market noise. Market noise refers to random price movements due to minor market fluctuations and can lead to false signals and misleading trends. Day traders are more affected as they might trade off hourly charts or even shorter time frames. Ideally, Forex traders should use a longer time frame to define the primary trend of whatever they are trading.

Impact Of Bid-Offer Spreads

The very nature of short-term Forex trading is the execution of multiple trades over short periods, typically less than a day. Unlike other markets, in the Forex market the cost to trade is typically built into the spread, and the wider the spread the more it eats into profits on entry and exit into trades where a successful trade may only be a 10 pip profit.

As scalpers and day traders rely on small price movements to enter and exit trades, the profit per trade is highly impacted by spreads. In volatile markets, slippage, where take-profit and stop-loss orders are filled at a worst than expected price, can also further reduce potential profits.

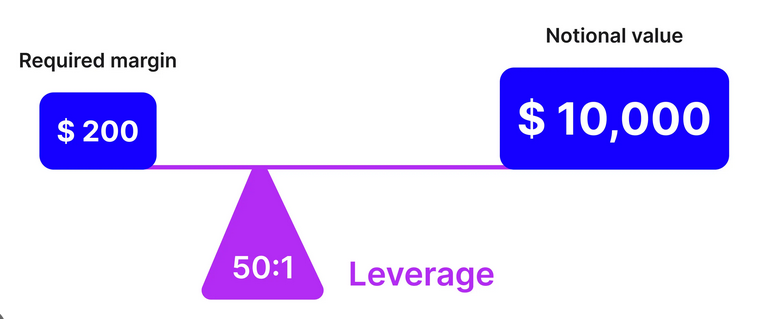

Leverage Risk

Scalpers and day traders typically use higher leverage to boost profits from small price movements. While leverage can increase profits it also magnifies potential losses. For example, a trader leveraging 50x to open up a $250,000 USD/JPY trade is now fully exposed to this large position, likely dwarfing the trader’s actual capital account balance. Nothing short of a very tight stop-loss is acceptable when using leverage.

Understanding leverage and managing the associated risks has complexity and for some traders this is is difficult to grasp. Without a tight stop-loss and disciplined money management to only trade 1% to 2% of your trading capital account, then short term strategies can cause significant losses. A tight stop-loss may be as little as ten pips from the current spot price.

Over-Trading Risk

Short-term FX traders are at risk of over trading due to the inherent nature of trading in a system that requires multiple small trades every day to be profitable.

The high frequency of trading opportunities when trying to capitalize on small price movements within a short time frame is a particular problem as it can tempt traders to execute more trades than necessary.

The pressure to meet daily or weekly profit targets is an over-trading risk factor, especially if a trader is behind on their targets. The pressure to make budget can lead to poor decision making and taking on trades with a lower chance of success.

A Reliance On Sophisticated Tools And Techniques

To be successful as a short term trader requires access to advanced trading tools and up to date technology which can be expensive with both start up and ongoing costs. It includes:

- High-speed internet connectivity

- A high-specification computer with upgraded graphics card and memory to reduce lag

- Advanced charting and analysis software

- Direct market access via a Forex broker

The need to develop or understand complex trading strategies is also essential for a successful short-term trader. These can be difficult to master especially those based on advanced technical analysis, algorithmic trading or high-frequency trading tactics.

Psychological Stress And Emotional Discipline

Short-term Forex trading requires constant monitoring of the markets and quick decision making. It can be tiring mentally as traders must stay focused for long periods. The need to perform well on a daily basis can lead to burnout or trading decisions driven by emotions like greed and fear which can override rational analysis and decision making.

Furthermore, pressure to rapidly recover from losses can also lead to revenge trading, where traders take poorly calculated risks to recoup the fall in capital on their trading account.

If You Can, Trade for The Long Term

Many Forex traders cannot trade for the long term to become position traders. The reason is day traders need to make money every day to earn a living by scalping the market. A couple of pips here and there only creates a decent trading profit through frequent trading many times a day.

Taking a longer-term strategic position will require a deeper stop loss and trading with a higher percentage of your capital account. A larger transaction size justifies inactivity in the market by holding out for more significant currency moves.

A long-term trading strategy means that you are not affected by what happens on any one given day. You can forget about having to predict short term trends and you will have more chance making money Forex trading.

A table showing the differences between short-term and long-term trading

| Factor | Short-Term Trading | Long-Term Trading |

|---|---|---|

| Goal | Benefit from small price movements | Gain from big market trends |

| Time Frame | Minutes, hours and days | Weeks, months and years |

| Trading Frequency | High, with multiple daily trades | Low, with few trades |

| Profit and Loss Realization | Quick, usually on the same day | Slow, realized over a long time |

| Capital Requirements | Low per trade | High per trade |

| Risk management | Tight stop-losses | Wider stop-losses |

| Analysis type | Technical analysis | Fundamental & Technical Analysis |

| Trading stress level | High, due to constant monitoring | Lower, due to reduced monitoring |

A video explaining the benefits of long-term over short-term Forex trading

A Parting Thought

The Forex markets are a market of probabilities and not certainties. Trading long term Forex trends makes big profits. If you have the capital forget about trading the short term where unpredictable or unforeseen events will always mean that the odds are on a knife edge.

Additional Resources

Seven fundamental Forex trading tips

Written by Chris Gillie

Chris Gillie is the founder of Axcess FX, a Forex software review and research website. He is a former investment banker who worked in FX Sales on the UBS London trading floor. Chris has been using Forex trading software as part of his trading set-up since the late 2000s and the embryonic days of MetaTrader and the MQL coding language.